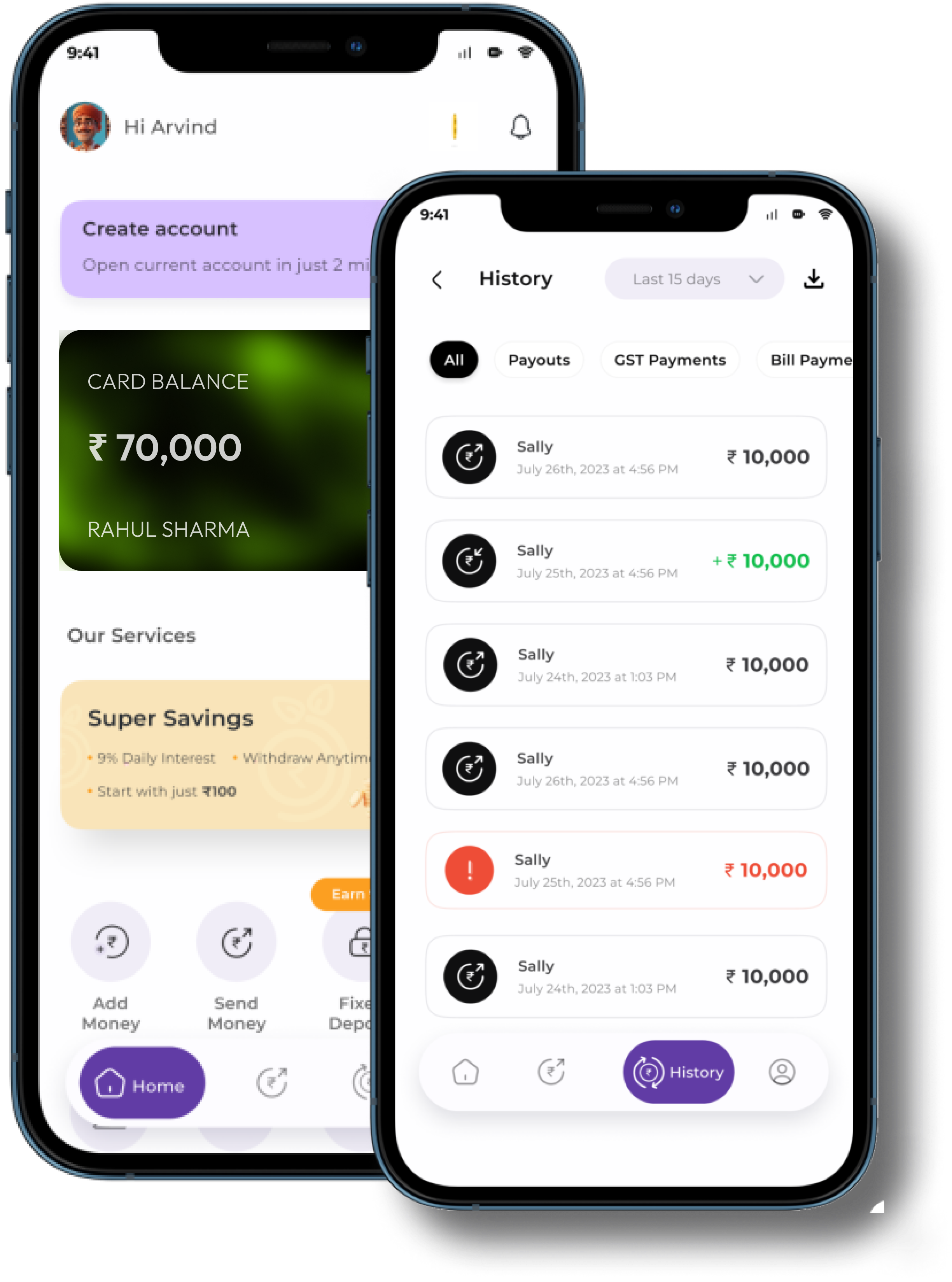

Enjoy effortless banking, designed for MSMEs

Easy to use

Web app, Mobile app, APIs and integrations

Automate Payments

Use Groups and tags to make rapid payments

Instant Payments

Enjoy unlimited payments on the move 24*7

One stop solution

An accounts for all your financial needs

Frictionless payment

-

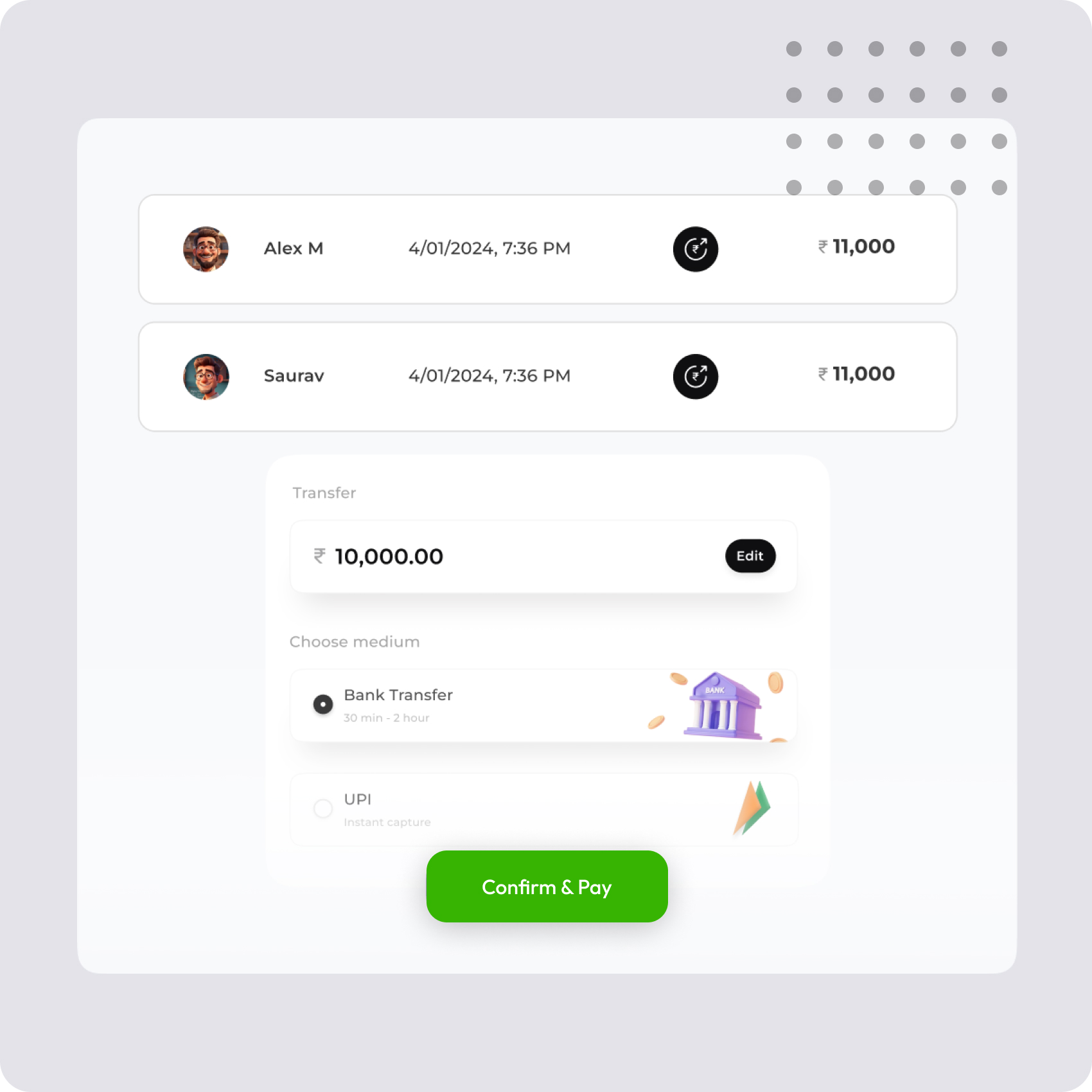

Make frictionless bulk and automated payouts

Make frictionless bulk and automated payouts

-

With no daily monthly limits

With no daily monthly limits

-

With UPI, IMPS, NEFT and RTGS

With UPI, IMPS, NEFT and RTGS

Collect efficiently

-

Multiple QRs to manage Multiple branches and franchisees

Multiple QRs to manage Multiple branches and franchisees

-

Say goodbuy to 1.5 to 3% charges,Pay flat fees

Say goodbuy to 1.5 to 3% charges,Pay flat fees

-

Get instant settlement to your bank

Get instant settlement to your bank

Automate Payments

-

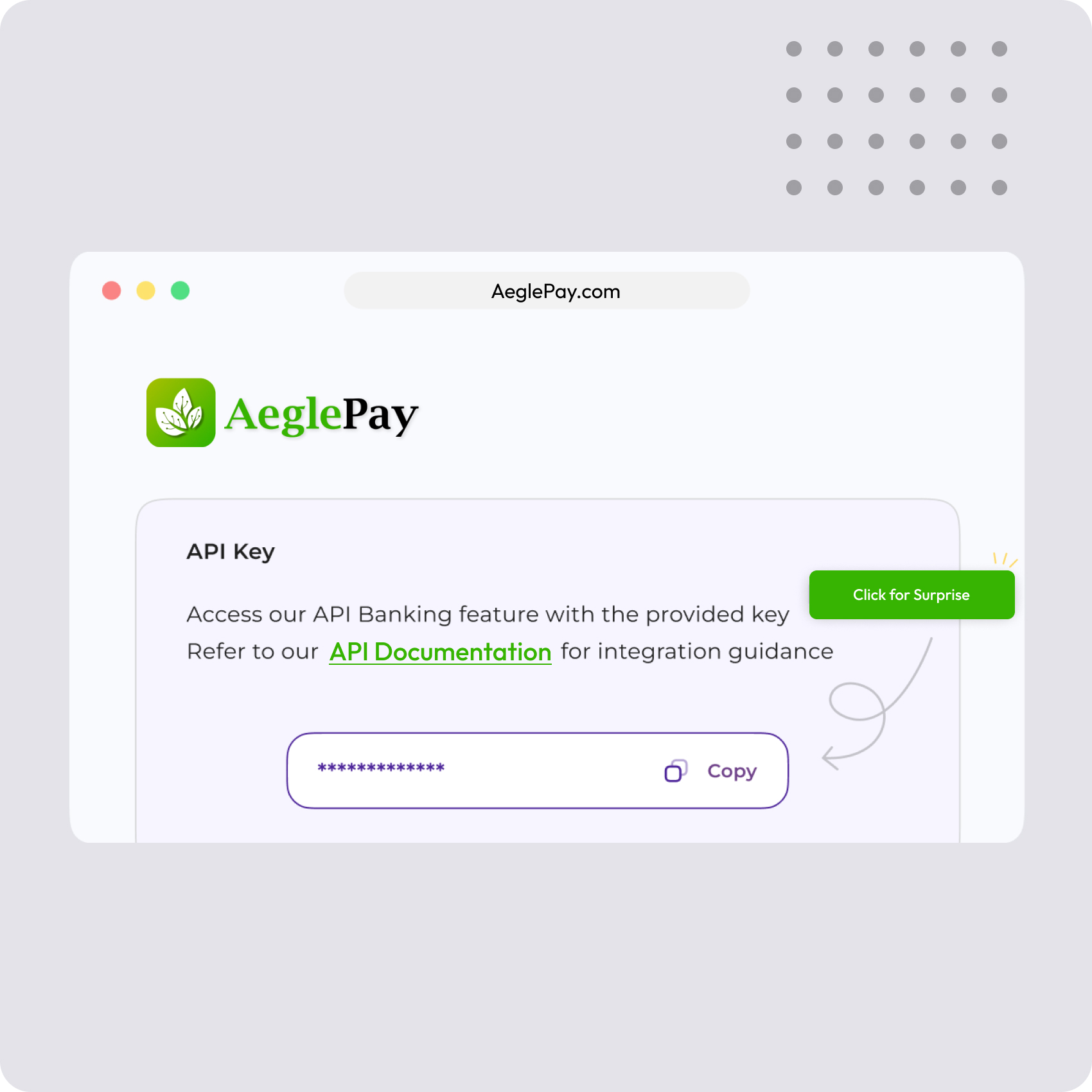

Make payments via APIs, Web and Mobile Apps

Make payments via APIs, Web and Mobile Apps

-

Simplified Payment APIs with support

Simplified Payment APIs with support

-

No one time setup fees or additional charges

No one time setup fees or additional charges

We are Building for the MSMEs in India.

Empowering 63 million MSMEs to become financially aware of their business and have an end to end control over banking and payments that is easily accessible.

Are you a Large size FMCG, Fintech, Hyperlocal, F&B business, Multiple Branches, NBFC, Accounting Platform, Investment Platform, Mobile App, Wholesaler, Reseller, Marketplace, Ecommerce, Saas, Payroll Management, Vendor Management, any other small business owner?

We can help you make your business payments frictionless just like how UPl apps did for your end customers.

Frequently Asked Questions

(FAQ)UPI, IMPS, RTGS, NEFT. All four method don’t have any daily or monthly limit.

There's no per day limit like banks. However, there is an INR 1 lakh limit per transaction on UPI, INR 5 lakhs on IMPS, and no limit on NEFT and RTGS.

Open an account in a few minutes by verifying your aadhaar, pan card and business details.

As per RBI guidelines, It is mandatory to verify aadhaar and pan card to create a virtual / individual current account.

Yes, you can. Aeglepay has a sub virtual account feature where you can create individual virtual accounts for each branch, franchisee or business of yours. This will enable you to reconcile transactions easily, and be on top of money in and out.

Aeglepay is an online web and mobile application that allows businesses to easily handle money in and out. Aeglepay enables businesses to perform bulk payout transactions in seconds and collect payments from customers via UPI, QR, and bank transfers. Aeglepay also allows businesses to produce invoices that can be delivered by WhatsApp or email in a one click, complete with a payment collecting URL.

Made in India to empower MSMEs

We are recognized by Startup India and DPIIT